Discover more than 74 paper bag hsn code in.duhocakina

The scrap is the supply of tax under GST norms, its rate of GST has depended upon the nature of the scrap and the HSN code. For determining the value of supply or GST the tax obtained at the source in the provision of income tax 1961, should not be included.

an invoice form with the words tech guruplus on it

Chapter Heading 4707 - "Recovered waste or scrap of paper or paperboard", continues to be under CGST Rate of 2.5% as per serial no. 198B OF Schedule I - 2.5% CGST Rate Notification No. 01/2017. 4) Kraft Paper, Paper & Board - 12% Chapter Heading 4804 - "Uncoated kraft paper and paperboard, in rolls or sheets, other than that of heading 4802.

Cut GST on metal scrap The Hindu BusinessLine

The details of reduced GST rate on Paper waste or scrap is as follows: HSN number: 4707 Paper waste or scrap GST rate before 06th October, 2017: 12% Reduced rate of GST w.e.f 06.10. 2017: 5% I hope, you have satisfied with this information about reduced GST rate on Paper waste or scrap.

GST Rate on Sale of Scrap Materials with HSN Code SAG Infotech

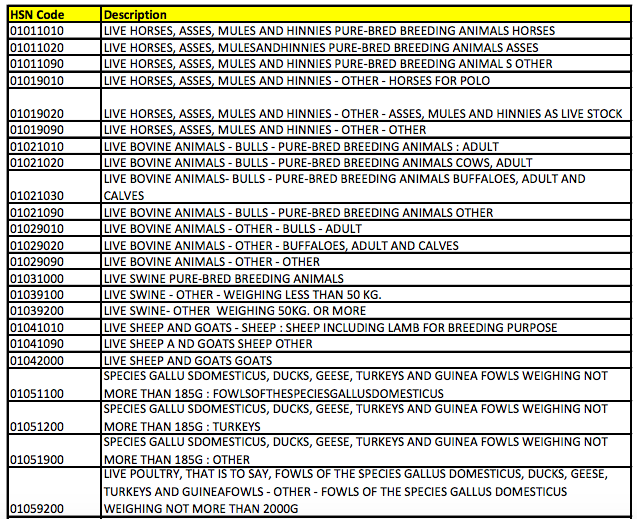

GST - Concept & Status, Overview Guide on Exports / Imports tax rates Sub-heading / Tariff item SGST / UTGST Rate (%) 0303, 0304,0305, 0306, All goods [other than fresh or chilled] pre-packaged and labelled. Ultra High Temperature (UHT) milk

Old Newspaper Waste, For Recycling at Rs 28/kg in New Delhi ID 24016011630

Disclaimer: Rates given above are updated up to the GST (Rate) notification no. 05/2020 dated 16th October 2020 to the best of our information. We have sourced the HSN code information from the master codes published on the NIC's GST e-Invoice system. There may be variations due to updates by the government. Kindly note that we are not responsible for any wrong information.

Hsn Explanatory Notes ticketsintensive

HSN codes and GST rates for (waste and scrap) paper or paperboard that falls under Chapter 48 includes Newsprint in rolls or sheets, Uncoated paper & paperboard, Vegetable parchment HSN Codes (waste and scrap) paper or paperboard:

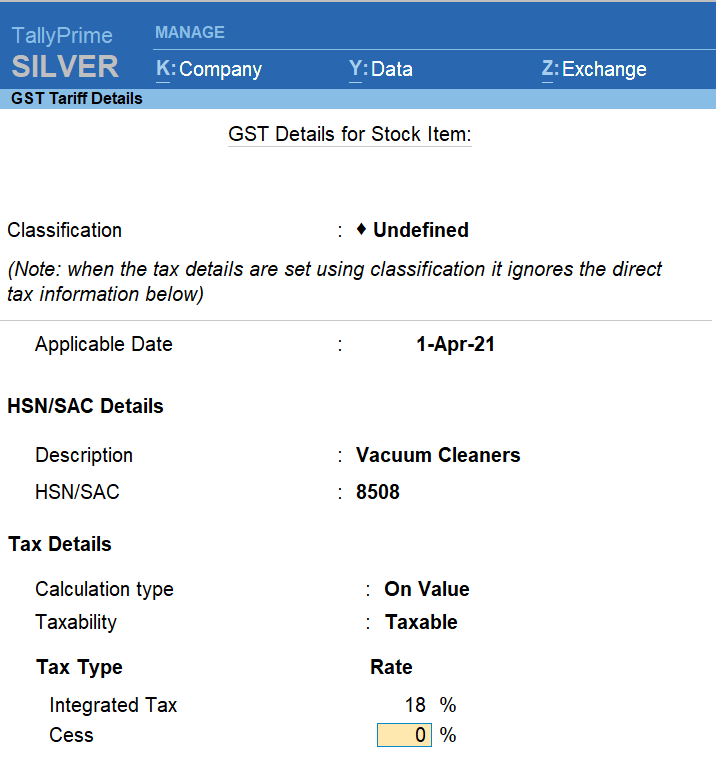

How to Manage HSN Codes/SAC and Tax Rates in TallyPrime TallyHelp

April 27, 2021 Under the GST regime, scrap and waste have not been related to the GST Laws but despite that sale of scrap is considered as 'supply' in course of business which is why the GST rate and HSN code are applicable.

Beautiful Gst Tax Invoice Template Excel Sample Network Diagram In

GST rates for all HS codes. You can search GST tax rate for all products in this search box. You have to only type name or few words or products and our server will search details for you. Tax rates are sourced from GST website and are updated from time to time. Note: You are adviced to double check rates with GST rate book.

GST Rate & HSN Code for (waste and scrap) paper or paperboard Chapter 48

Home GST GST HSN Code HSN Code & GST Rate for Paper, Paperboard Articles & Newsprint - Chapter 48 Updated on: 23 Nov, 2023 01:22 AM HSN Code & GST Rate for Paper, Paperboard Articles & Newsprint - Chapter 48 File with us to win your taxes Ready to File! Start Now! Smart, Simple and 100% free filing Personalised Tax Filing experience

GST Rate & HSN Code for Services Chapter 99

GST on sale of scrap or waste to unregistered person It should be noted that supply of used vehicles, seized and confiscated goods, old and used goods, waste, and scrap by the Central Government, State Government, Union Territory, or a local authority to an unregistered person is also a taxable supply under GST.

GST slab rates in India 2022 easily explained TaxHelpdesk

Paper Products Taxable at 5% GST Rate Newsprint, in rolls or sheets, is taxable at 5% GST rate. This is the only paper product taxed under this rate. Paper Products Taxable at 12% GST Rate Uncoated paper and paperboard, uncoated kraft paper, greaseproof paper, glassine paper, composite paper etc. Aseptic packaging paper

metal scrap rate today metal scrap rate iron scrap price today steel scrap price today

SCRAP PAPER PAPERBOARD - GST RATES & HSN CODE 4707 Save upto 7% in taxes Claim 100% ITC and save ~4% GST Save 2 man days every GSTIN month Home HSN Code Pulp of wood or of other fibrous cellulosic material; recovered SCRAP PAPER PAPERBOARD - GST RATES & HSN CODE 4707 GST rates and HSN code for Scrap Paper Or Paperboard. Origin Chapter: Chapter 47

Javadekar indicated rebate in GST rate on vehicles, vehicle scrap policy declaration soon feasible

The GST rate for waste and scrap paper or paperboard is 12%. This rate is applicable to all types of waste and scrap paper or paperboard, including those that have been sorted or graded. Therefore, businesses dealing with waste and scrap paper or paperboard must charge a GST rate of 12% on their products.

Implementation of GST and Act of GST Example TutorsTips

(waste and scrap) paper or paperboard GST Rate & HSN Code for (waste and scrap) paper or paperboard - Chapter48 GST Rates & HSN Codes for Newsprint in rolls or sheets, Uncoated paper & paperboard, Vegetable parchment - Chapter 48

GST Rate & HSN Code for Iron and steel Chapter 72

4701 to 4823. Chapter 48. Paper and paperboard, articles made of paper pulp, or articles made of paper or paperboard. 4801 to 4823. Chapter 49. Printed books, pictures, newspapers, and other products of the printing industry, typescripts, manuscripts and plans. 4901 to 4911. Section XI. Textile and Textile Articles.

Discover more than 74 paper bag hsn code in.duhocakina

The highest rate for scraps material is 18%. HSN code is a 6-digit code that categorizes 5000+ products. It is a uniform code which is accepted worldwide.